The Fund

Joe Williams Story

Joe Williams is a real estate industry leader who co-founded Keller Williams Realty in 1983. Today, Keller Williams is the largest privately held real estate franchise in the world, with over 190,000+ agents in 60+ countries, literally from Aruba to Zurich! The company closed over $472B in worldwide sales in 2022.

Joe's favorite asset class is land and has primarily worked in high-demand markets such as Texas, Florida, and North Carolina. He constantly stays on top of new opportunities, which his agents bring to him due to their deep connections to local clients in these communities. As he points out, “Insider trading is perfectly legal in real estate!”

We intend to cause the fund to acquire raw land and distressed properties to enhance its value through entitlement i.e. site planning, zoning, limited horizontal additions, then resell the tracts to vertical developers and share any resulting profits with Fund investors.

Managing Partner

Long-Term Relationships

with Our Keller Williams Agents

We currently intend to leverage our unique network of relationships with our KWR agents and their local contacts to obtain access to a broad range of investment properties that are often “Off-Market” and often unknown to the Fund’s competitors.

We believe that this will give the Fund a marketing edge because we have so many local KW agents in place in the USA. They know the areas they live and work in. Our commercial agents in that town already know the RE experts we need to properly and quickly evaluate the potential feasibility.

Once we’ve locked on to an opportunity, using the Fund structure allows us to move quickly to tie up the parcel and get to work entitling through site planning, engineering, zoning, etc. with the final result being a “shovel ready” parcel for vertical developers who routinely don’t have the time or local expertise to accomplish this critical step.

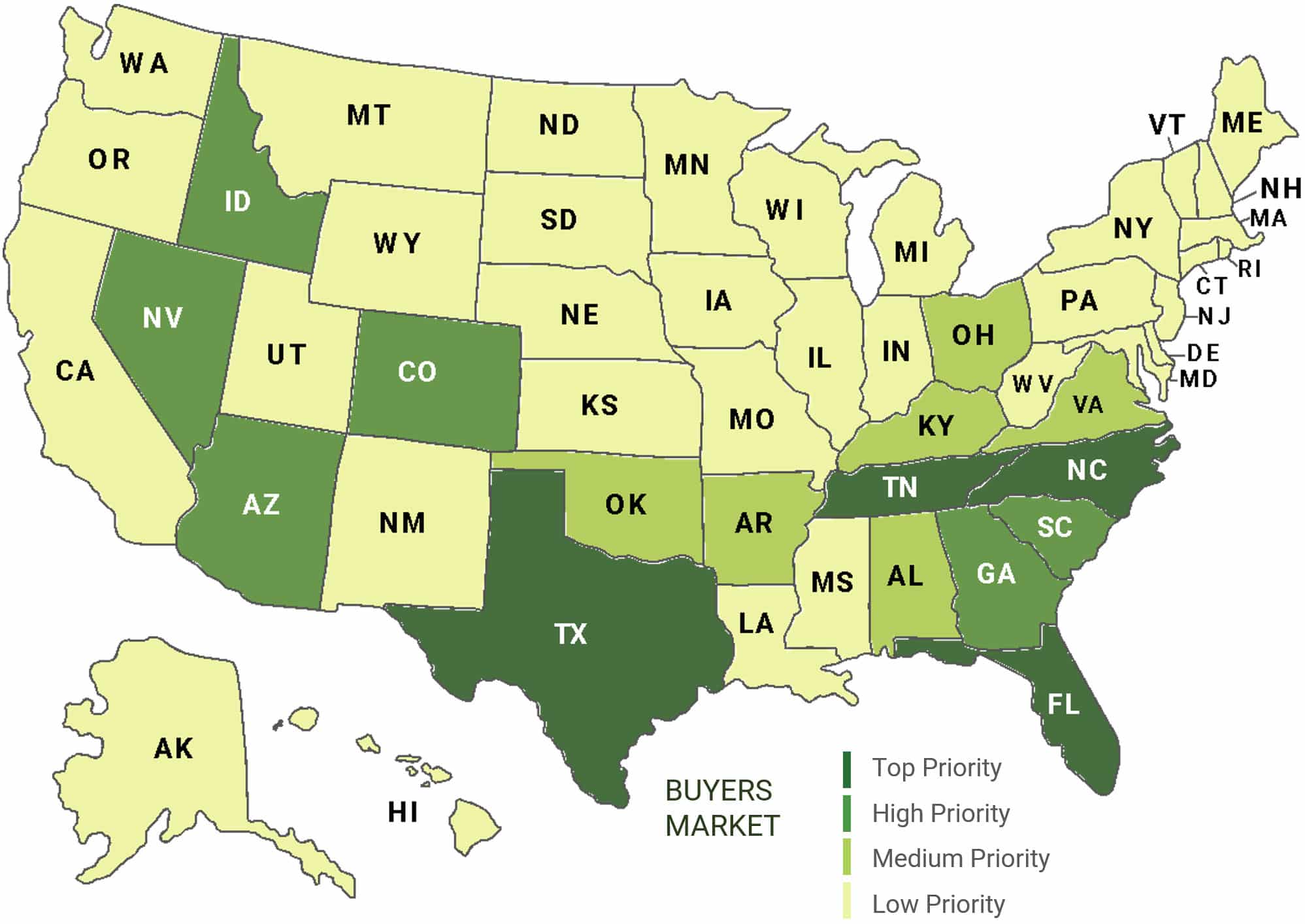

We have local expertise in Top 10 markets across the U.S. to find and entitle off-market tracts at below-market pricing.

$150M+

In AUM

2,300+

KW Commercial Agents

190,000+

KW Residential Agents

The Four Basic Opportunities We See

Scenario #1

Buy-Hold-Sell

Acquire the land in a high growth corridor. Maintain the land, pay the taxes, reap the high appreciation and sell in 2-3 years. The inside sourcing & purchase price up front was the key to value creation.

Scenario #2

Buy-Entitle-Sell

We source an off–market tract with high entitlement potential. The tract is then engineered & site planned to sell to a vertical builder(s), user, or developer.

Scenario #3

Buy-Entitle-Utilities-Sell

In certain cases after a site plan, we bring utilities, roadways, and tax incentives in order to attract a higher end user/developer for an exit.

Scenario #4

Distress Scenarios

With our sourcing ability we often see excellent projects where the original developer is short on time or capital, but their “dream” was correct! We can step into a GP position!

Where We Look to Focus First

Keller Williams has over 66,271 residential and 1,101 commercial associates in the Top 10 destinations alone!

Investing

— in the —

Fund

Is there any instance when the fund will do vertical development?

Land entitlement is a part of any development process. However, if the question is around hard costs, (physical development), the Fund may do off-site horizontal development if the market indicates that this investment of bringing utilities to the site will provide the highest and best returns. In the case of the Fund acquiring a distressed property where vertical construction is started or planned is the only case where the Fund would take part in vertical construction.

Why such demand for entitled land at this stage?

Real Estate flows in cycles and at this stage we’ve had experience that acquiring the right parcels and working through the entitlement process is the right thing to be doing now. Vertical developers in all asset classes know entitling land is the most difficult part of the building process and are happy to allow experienced operators like the Fund’s team to get that process done first. We believe they also fully understand there is added value to be paid to acquire a “shovel ready” site from the Fund.

We will work diligently to provide all invested capital plus preferred return back to our investors as quickly as possible. Leveraging our large KW Commercial network will also provide us buyers early in the entitlement cycle so that we are working alongside those buyers during the entitlement cycle that may be under contract to purchase as soon as the property is entitled for their use.